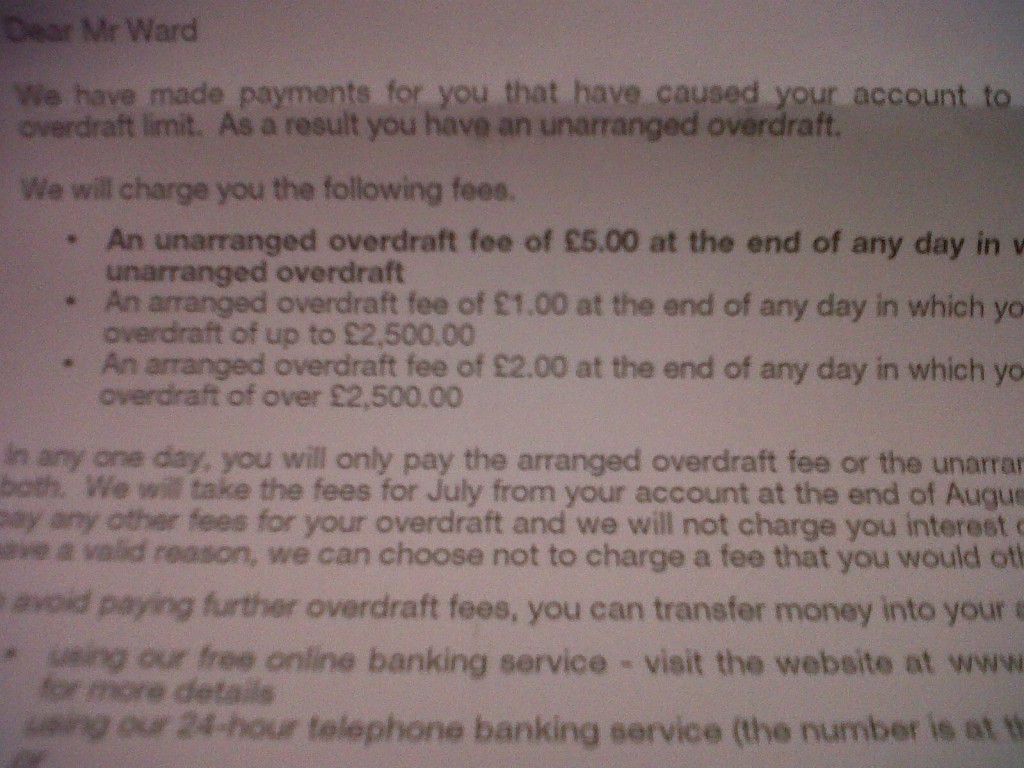

Good news: I have been charged only £5.00 for going 70p into the red last week as I reported here. While this is still somewhat disproportionate, the author believes this is fair because the bank was paying its own cash to cover the unauthorised overdraft. Please see the comments below for continued discussion of whether the £5 was fair.

Justice

Obtier, in jurisprudence, we learned the importance of symobolism in legal theory and practice. Lady Justitia is, perhaps, my favourite of all characters. Justitia has been depicted most commonly as a matron carrying a sword and scales, sometimes wearing a blindfold.

In the context of University law exams the matriculation number replacing the student’s name is perhaps the examiner’s equivalent of Justitia’s blindfold: that marks should be impartial, unbiased and justified.

But I digress. I have a small bank charge to pay and won’t make the mistake of mixing up my bank cards next time!

Want to learn more about Lady Justice?

See this Sword and Scales book, this Wikipedia article or WardblawG’s collection of Justitia Pictures.